AARP Tax-Aide is offering free tax clinics at both the Central Library on Quincy Street and the library branch on Columbia Pike. The nationwide program helped over 1.7 million people in the 2024 tax year with 28,000 volunteers at 3,300 sites.

Karen Miller, Tax-Aide and the local coordinator at the Central library location in Arlington, says they have done

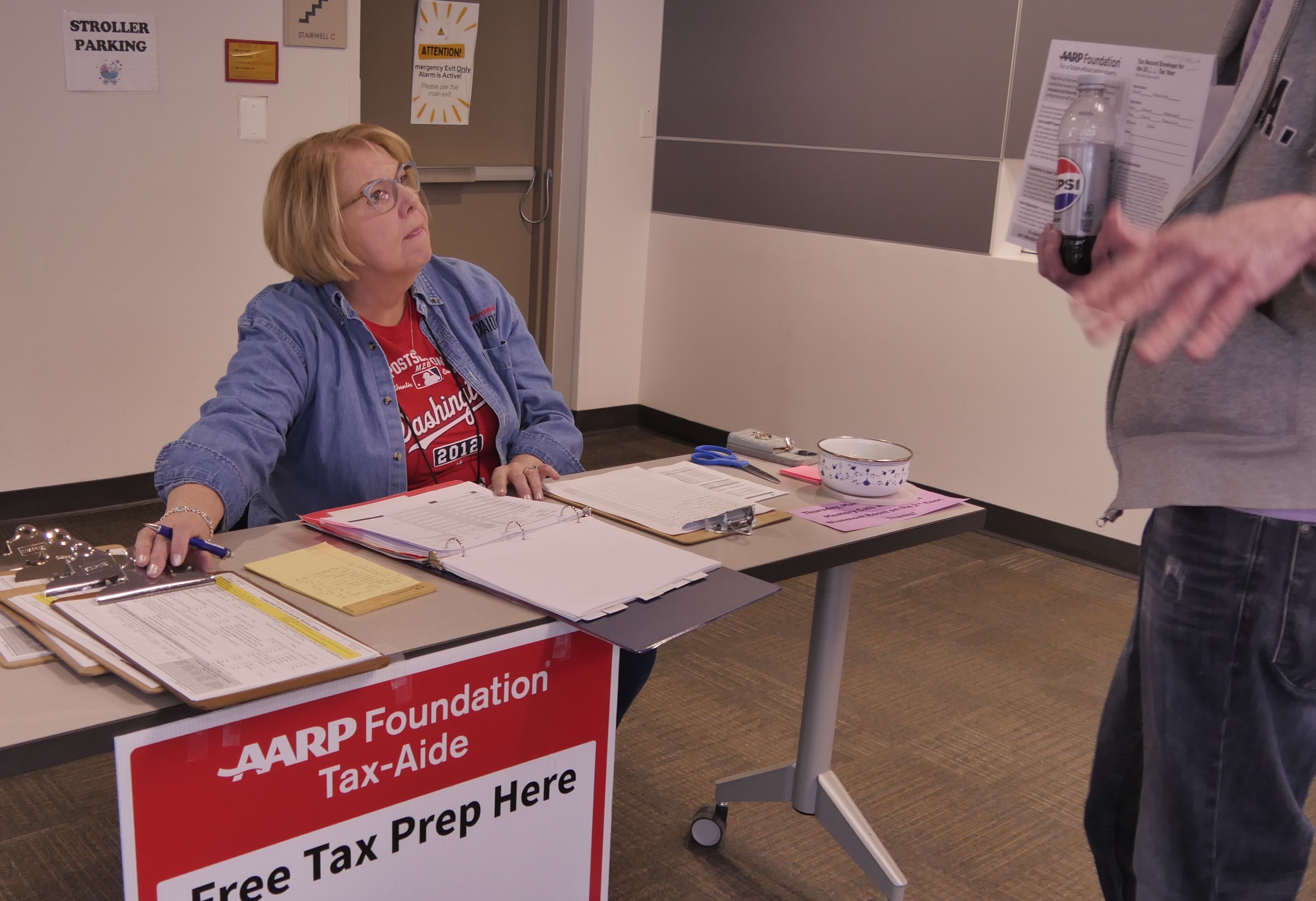

Melissa Adzam checks in the appointments for free tax assistance.

Melissa Adzam checks in the appointments for free tax assistance.

about 700 returns since the clinic began in February this year. Miller says the program is geared to seniors but “we also do many families and some students.”

Although there is no income limitation on the free assistance, Miller says there are some returns that are out of scope for their services. “For instance, we can do small businesses and do a lot of Uber drivers. But we can’t help a small business if they have employees, investments or business losses.”

Melissa Adzam, who is at the front desk checking in applicants, says they schedule three slots every 15 minutes. She has seen a steady stream of people this morning. Miller says they take appointments as a priority but also welcome drop-ins. Currently they have two rooms full of tax counselors assisting people with their returns. “We do about 50 appointments a day.”

Miller explains the entire process for a usual appointment takes about two hours. First a tax counselor conducts an interview. Then they prepare the tax return. A second person double checks the return, and then it gets filed. “Of course it depends on how complicated the return is.”

Miller says an applicant needs a social security card, a government-issued ID, their W-2, 1099, and last year’s tax returns are helpful, too. She says there are always a few people who don’t bring what they need. But they do require applicants to fill out an intake/interview and quality review sheet ahead of time that helps guide people through what they will need to bring with them.

This year a new option has been added for those who want assistance filing their tax forms. It is called the facilitated self assistance option, “kind of a do it yourself.” Miller explains, “We provide the software and the assistance if they have questions. We help them get online, and start their return. They can take it home to finish it or file it here.” She says to take advantage of this option, the income level must be below $84,000. They must have a phone that can text, an email and be computer literate. She adds they haven’t seen too many people try this yet but it hasn’t been highly publicized. “This year was a soft rollout.”

Another available alternative, called the drop off option, was developed during Covid. A person comes for an interview but they leave their documents for the volunteers to prepare. Then they come back a second time to finalize the forms. “We usually schedule these at the end of the day.”

Miller says she has the best volunteers, and one of them interjects in turn that Miller “is the best volunteer leader I’ve ever met.” Miller estimates she has about 35 volunteers with 9-12 of them assisting tax clients at a time. Many have been assisting for a number of years but “we have new volunteers, too.” The volunteers are required to have in-person training every year along with practice exercises.

Hours for assistance at the Central library location are Tuesdays 10 am-7 pm and Thursdays 10 am-5 pm and at the Columbia Pike Branch on Tuesdays from noon-6:30 pm and Friday and Saturday 10 am-2 pm. For more information: novataxaide.org